Beginning in 2022, Partners is pleased to offer an added incentive for our donors who give monetary donations as these now quality for the Child Care Contribution Credit. The Child Care Contribution Credit offers an additional credit up to 50% on your state income taxes. The Child Care Contribution Credit applies to monetary contributions given to Colorado institutions that support child care for children under 12 and to certain approved nonprofits.

How could the Child Care Contribution Credit work for me?

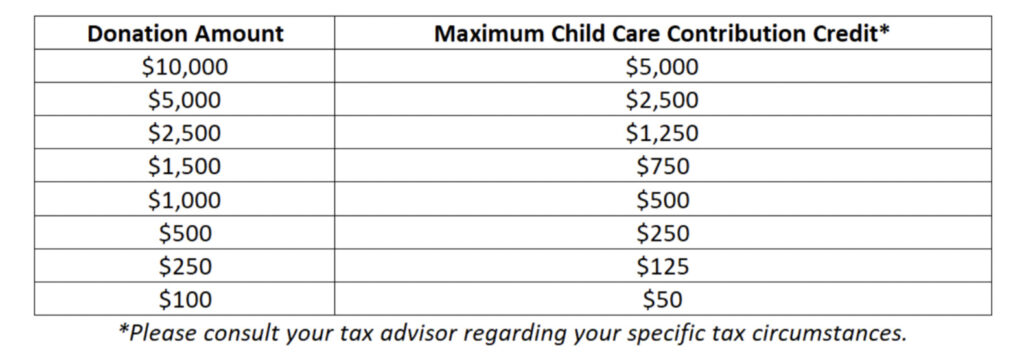

Half of your donation may be offset dollar-for-dollar against your Colorado income taxes. Plus, you may be eligible to claim a portion of your contribution as a charitable donation on your federal and state income tax returns if you itemize deductions. These deductions and credits substantially reduce the after-tax cost of such donations to taxpayers. Please see the table below to understand how the Chlld Care Contribution Credit may offset your donation.

FREQUENTLY ASK QUESTIONS

How can I make an eligible donation to Partners?

Mail a check to Partners (530 S. College Avenue, Unit 1, Fort Collins, CO 80524). Please write “Colorado Child Care Contribution Credit” on the memo line.

Give online at https://poweredbypartners.org/get-involved/#donate please select the Child Care Contribution Credit box.

Is the credit allowed for in-kind donations or gifts of appreciated assets?

No. Only monetary contributions, including qualifying distributions from individual retirement accounts are eligible. For more information please review FYI Income 35.

How do I substantiate my gift for tax purposes?

Partners will provide you with a Form DR 1317 along with your donation receipt.

If you have already given in 2022, please contact Partners Executive Director, Heather Vesgaard at: hvesgaard@poweredbypartners.org to ensure that you receive proper credit.

Is there a limitation on the amount of credit?

The credit a donor can claim for qualifying contributions made during a tax year is limited to $100,000. If the credit exceeds the donor’s tax liability, it may be carried over to the next year, for up to five additional tax years.

How will Partners use your gift?

The funds will be utilized by our community and school-based programs in the following ways: to support mentoring partnerships, provide activities for youth as they wait to be matched with a mentor, provide kids new skills through prevention education courses, mentor training, and provide healthy snacks to kids during activities.

How can my gift make a difference?

- $1,800 supports one mentoring partnership for a full year, allowing a local youth to achieve their full potential.

- $500 allows youth on our waitlist to experience fun and educational activities.

- $250 allows kids to develop new skills through regular prevention education courses.

- $100 helps mentors thrive as role models by providing training.

Additional questions?

Please contact Heather Vesgaard, Executive Director.

970.484.7123 │hvesgaard@poweredbypartners.org

![Partners [Logo Reversed]](https://poweredbypartners.org/wp-content/uploads/2020/06/partners-horiz-no-tag-sm-rgb-color-purple.png)